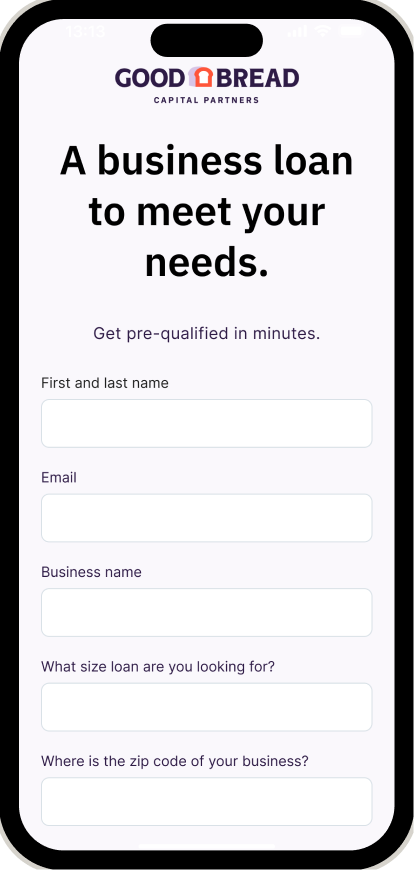

GoodBread is building a new small business lending platform – one that starts with trust, getting to know both the business and the person behind it.*

*Currently GoodBread is making $5k starter loans and up to $100K follow-on loans to businesses in New York.

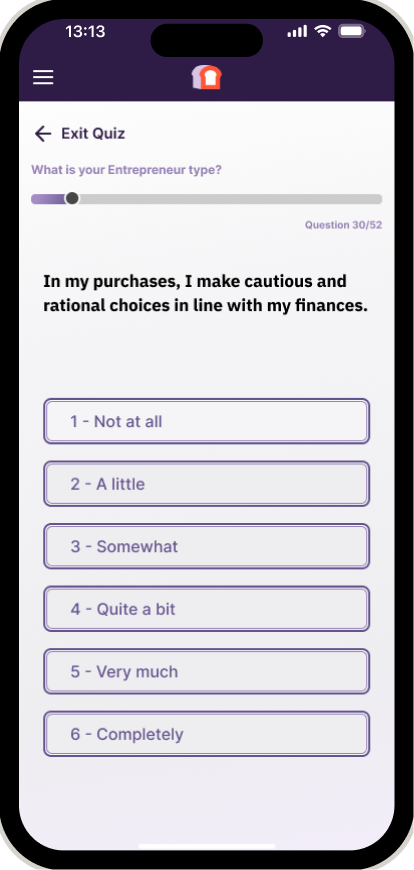

We underwrite based on a richer picture—personality, behavior, business fundamentals, and momentum—so we can make better decisions and support more business owners.

We’re building the go-to capital partner for small business owners – supporting both the individual and the business with funding and services for long-term growth and sustainability.

We’re developing tools that combine behavioral insights, character traits, and real-time financials to open doors that traditional models miss. We look for ways to get to yes!

We’re developing tools that combine behavioral insights, character traits, and real-time financials to open doors that traditional models miss. We look for ways to get to yes!

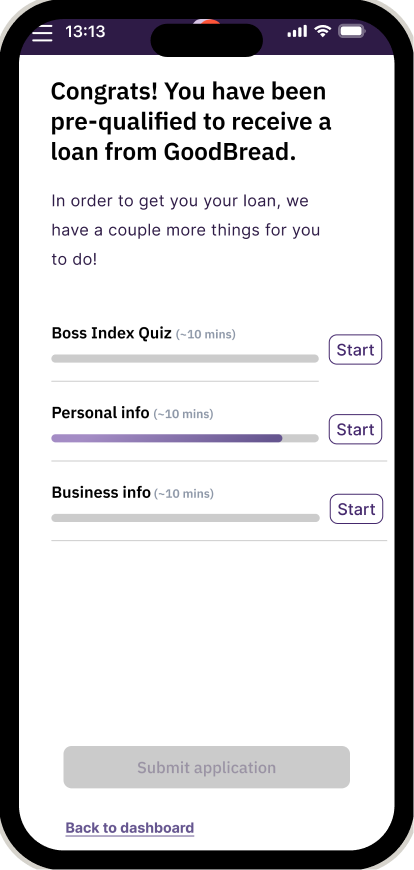

Yes! For well-qualified small businesses, we offer $5k starter loans. Once the starter loan is fully repaid, clients are eligible to apply for term loans up to $100k.

Businesses need to have a separate legal entity, business bank account, and have been in business for at least 6 months to apply. The business needs to demonstrate ability to repay the requested loan on current cash flow and have a business use for funds that aligns with growth and sustainability.

GoodBread is different because we underwrite the whole person – blending behavior, character, and real-time financial data – and go beyond repayment with servicing that supports growth, leadership, and connection. We’re not just giving out loans; we’re building lasting partnerships.